“A 60:40 allocation to passive long-only equities and bonds has been a great proposition for the last 35 years,” …”We are profoundly worried that this could be a risky allocation over the next 10.”

– Sanford C. Bernstein & Company Analysts (January 2017)

“Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.”

– Sir John Templeton

“Life and investing are long ballgames.”

– Julian Robertson

(Source: Author’s Photo)

Introduction

In February of 2009, I voluntarily left a senior analyst position at one of the largest RIAs in the United States to start an investment firm from scratch, with zero clients and only my own saved capital to invest. That is how confident I was in valuations and the prospect for outsized returns.

With the benefit of hindsight, this seems like an easy decision, but at the time, there was substantial fear, and more than one person close to me asked me what I was doing, and advised me against the decision I was making.

Personally, in the Fall of 2008 and the Spring of 2009, I bought out-of-favor equities. These included undervalued, unloved, and under-owned shares of Macquarie Infrastructure (MIC), General Growth Properties (GGP), First Industrial Realty Trust (FR), Genworth Financial (GNW) and Ruth’s Chris Steak House (RUTH).

Additionally, during the depths of 2008 and early 2009, I purchased shares of “left for dead” banks like Fifth Third Bancorp (FITB), downtrodden MLPs, including Atlas Pipeline Partners (and Atlas Energy), which received an investment from Chevron (CVX), and ultimately was acquired by Targa Resources Corp. (TRGP) in a series of transactions.

Crosstex Energy, L.P. was another severely undervalued MLP company that I acquired a sizeable interest in during 2009. In 2013, Crosstex Energy, L.P. merged with the midstream assets of Devon Energy (DVN) to form EnLink Midstream Partners, L.P. (ENLK). As part of this transaction, the publicly traded general partnership interest, which was previously Crosstex Energy Inc., was combined with Devon’s assets to create a new publicly traded general partnership interest, which took the name of EnLink Midstream, LLC (ENLC).

Looking back, tracking the MLP transitions, mergers, and acquisitions over the past decade has required at least an accounting tool, and maybe even an accountant.

Candidly, there were not many bad investments from the 2009 time frame, and a monkey throwing a dart could have probably done well. With the benefit of hindsight, I did nothing special other than being greedy when others were fearful. Really, an investor or speculator could have bought almost anything that survived from the Fall of 2008 through the Spring of 2009, and done very well simply by closing their eyes and holding on for dear life.

In fact, as I would learn, the more downtrodden a security or investment, the better, particularly at the end of a bear market, when the bear market transitions to a new bull market.

This time frame (late 2008 and early 2009) was very much like the famous story of Sir John Templeton borrowing money in 1939, when World War II began in Europe, and buying 100 shares in 104 companies trading below $ 1, including 34 companies that were in bankruptcy. Think about that a minute. Buying shares of GGP, which was in restructuring in 2008/2009, was similar to what Templeton did in the late 1930’s.

In 2008 and 2009, I found success via my hunt for undervalued, out-of-favor securities. The same pursuit led to value traps later in the current bull market, though, and I have had painful learning lessons, and growing opportunities, throughout my 20-plus-year investment career, including a character building, very challenging year in 2017.

Building on this narrative, the turnaround happened so quickly in 2009 and 2010 that I remained skeptical of the gains in the stock market, and the prospects for economic growth. In my mind, I attributed the quick gains to central bank intervention, believing they were artificial. Extrapolating, I thought there was no way that unlimited money printing, aka Quantitative Easing, could not lead to substantial inflation, and relatively quickly.

Wow, was I wrong on this prediction.

Circa 2010, and even more in 2011, I was convinced we were in for a period of slow economic growth and anemic stock market returns for the foreseeable future.

Wrong again!

Reviewing the post 2011 market environment, I got the forecast roughly right for economic growth, particularly global economic growth, which remained anemic, but I was woefully wrong on my assessment and forecast for the stock market. This was particularly true with regard to the S&P 500 Index, as measured by the SPDR S&P 500 ETF (SPY), which has unequivocally been the strongest developed stock market in the world.

(Source: William Travis Koldus, www.stockcharts.com)

Additionally, and frankly an even bigger mistake, I was bearish on some of the leading growth equities, including Amazon (AMZN), Netflix (NFLX), and Tesla (TSLA), which have thrived in the low global growth environment from early 2011 through early 2016, and I even shorted some of what I perceived were outrageously overpriced growth equities. These were painful learning lessons. Having said that, the short opportunity in these companies is even better today, as they are priced beyond perfection, in my opinion.

In summary, barely two years into what has become a nine-year equity bull market, led by U.S equities, thus far, I was already uncomfortable being bullish.

Additionally, from conversations with investors, my participation at Seeking Alpha, and my reading list, I have concluded that a lot of investors and speculators have been uncomfortable with this bull market, which is now one of the longest, and most unloved, bull markets in modern market history.

With that thought in mind, what if global economic growth bottomed in 2016, and is now poised to continue accelerating? How will that impact one of the most hated bull markets in history?

Thesis

Global economic growth is poised to accelerate, sending capital out of the U.S., and changing the character of the current bull market.

One Of The Longest Bull Markets In History

This bull market made me uncomfortable two years into its journey, all the way back in 2011, and I did not see how U.S. equities could rally for nine years. I would have bet this was impossible, and if you gave me a time machine, and I could travel to the future in 2011, I would not have believed what has transpired.

(Source: Ryan Detrick, LPL Research, FactSet)

The above chart, which was created by Ryan Detrick of LPL Research, and republished in this article, shows that the current bull market is the second longest in the post World War II era, trailing only the 1990 through 2000 bull market in length.

Economically Sensitive Sectors Have Underperformed

Intuitively, we know that this near record-setting bull market has been different, as investors have gravitated towards yield focused investments, including bonds and dividend growth stocks.

Visualizing the outperformance of defensive sectors over their economically sensitive counterparts is eye opening.

These defensive sectors, including bonds, as measured by the iShares 20+Year Treasury Bond ETF (TLT), and utilities, as measured by Utilities Select Sector SPDR ETF (XLU), have correlated closely with S&P 500 Index itself, which I argue has become a defensive, safe-haven global liquidity instrument.

(Source: WTK, www.stockcharts.com)

Meanwhile, economically sensitive equities, including energy equities, as measured by the Energy Select Sector SPDR ETF (XLE), and material equities, as measured by the SPDR S&P Metals & Mining ETF (XME), have dramatically underperformed.

Take in the chart listed above for a few minutes, which shows SPY up 101.6% over the last decade, TLT up 96.0% (which is even more remarkable in my opinion), XLU up 87.1% over the past ten years, XLE up only 10.8%, and XME down a remarkable -44.0% over the past ten years.

From looking at the above performance chart, where do you think the undervalued opportunities are today?

Economic Growth Is Already Accelerating

Now taking in the information from the decade performance chart, what if I told you that economic growth is accelerating.

Don’t believe me?

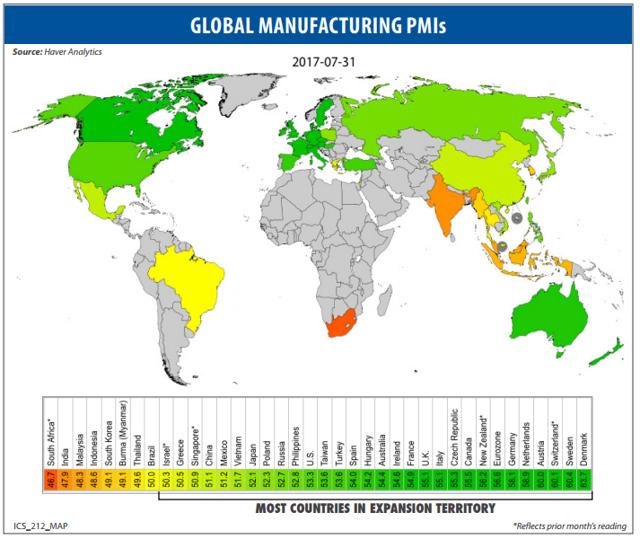

Look at these charts, which provide a graphic representation of accelerating global manufacturing growth and then accelerating U.S. manufacturing growth.

(Source: Ned Davis Research, Haver Analytics)

(Source: Bloomberg)

Clearly, global economic growth is accelerating around the world, led, ironically enough, by Europe, buoyed by the depressed relative value of the Euro over the past year.

Additionally, for all the political wrangling in the United States, growth is clearly accelerating, and this is without the benefit of any legislative catalysts thus far.

Expectations For Growth Still Very Low

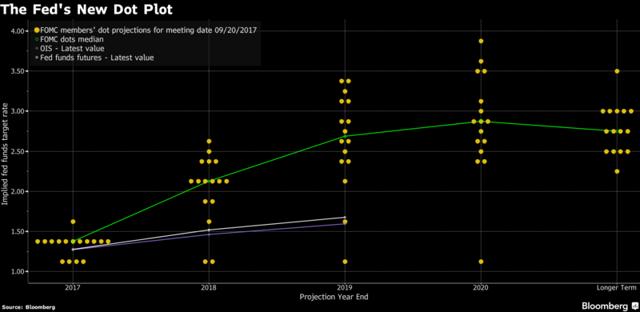

Following the FOMC meeting on Wednesday, September 20th, there was a revised dot plot graph published.

(Source: Bloomberg)

There was not much change from June’s rate hike expectations. Rather, the stark contrast is in the current Fed Funds Futures, shown in the above graphic with a white line, and the Fed Funds Futures severely undercut the expectations of the FOMC for future interest rates.

Said another way, the bond market does not share the Fed’s optimism for higher rates.

Thus, the market remains unconvinced that economic growth will continue to accelerate, as it has done from 2016’s bottom, where one-third of the world’s sovereign bonds traded at negative nominal interest rates.

Let that sink in for a minute.

Now, think about this possibility.

What happens if the financial markets are wrong about the trajectory for interest rates? What happens if the financial markets are wrong about their current expectations for global growth?

Takeaway: Expect The Unexpected

Almost every investor and speculator believes in the mantra, “lower for longer”. This applies to interest rates. It applies to global growth forecasts. It applies to inflationary expectations. Perhaps most importantly, it applies to commodity prices.

What happens if “lower for longer” is not accurate?

What happens if the bond market is wrong?

What happens if global growth accelerates?

What happens if inflation accelerates?

What do asset prices reflect today?

If everyone positioned for a reality that is different from what actually happens, where are the investment opportunities?

From my perspective, all investors and speculators should be asking themselves these questions today.

In 2009, I was certain that there were investment opportunities that we might only see once in a lifetime.

In 2011, I was bearish on the prospects for global growth and equity returns. I was spectacularly wrong on this forecast.

Today, I believe the discrepancy between global economic growth and the performance of stocks, bond, and commodities has set up an opportunity set that rivals 2009.

Investors around the world are already starting to emerge from the cocoon of the safe-haven U.S. Dollar, which surged from 2011 through 2015 (propelling U.S. stocks and bonds higher relative to the rest of the world), and repatriate capital to undervalued assets with better risk/reward potential.

(Source: WTK, www.stockcharts.com)

To close, despite the length of the bull market, the performance of the bull market has been has been highly bifurcated. Favored equities, including dividend growth stocks, bonds, and technology growth shares, have been bid up to historically high valuations, while economically sensitive stocks, including global growth equities and commodity equities have diverged tremendously.

This has been very painful for investors focused on value equities, but it has yielded historically compelling valuations. Thus, today, more than ever, from my perspective, it makes sense to look for the undervalued, unloved, out-of-favor opportunities.

For further perspective on how the investment landscape is changing, and if you are interested in joining a unique community of contrarian, value investors, and would like to see all of the historical trades and current positioning of the “Bet The Farm” and the “Best Ideas” Portfolios, please consider signing up for my premium research service, “The Contrarian.” This service has been well reviewed by its members, and I believe we are once again at a unique inflection point in the financial markets, for the third time in the past two decades. Thank you for your readership, and please “follow me” to get more of my public articles.

Disclosure: I am/we are short SPY, AMZN AS MARKET HEDGES.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Every investor’s situation is different. Positions can change at any time without warning. Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice.

Tech