My cautious tone toward AT&T (T) ahead of 3Q17 earnings has been justified.

This Tuesday, the U.S.-based telecom giant posted its first all-around miss since 3Q14. Revenues of $ 39.7 billion landed -3% below year-ago levels, failing to reach consensus estimate of $ 40.1 billion as business and consumer mobility came in softer than I anticipated. Entertainment did not perform well either, but much of the weakness on this side of the business had already been pre-announced and shouldn’t have caught investors by surprise.

Credit: 9to5Mac

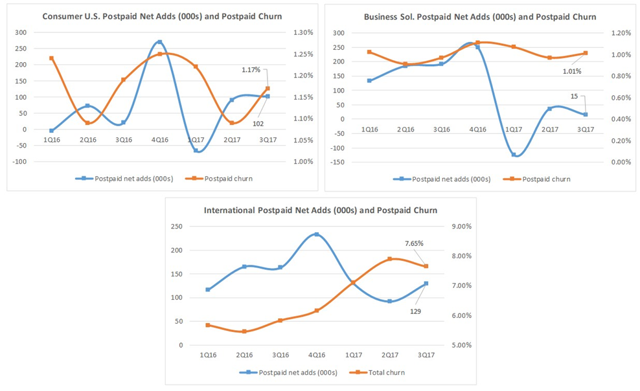

On mobility, AT&T’s key op metrics did not look particularly strong this quarter (see graph series below). Consumer postpaid net adds experienced a minor sequential dip to 102,000, while Business Solutions saw the same performance indicator head closer to zero, much lower than year-ago levels. On postpaid churn, consumer’s and business solutions’ ticked up to 1.17% and 1.01%, respectively — not very encouraging, but consistent with recent cyclical patterns. Even the faster-growing international segment could not celebrate much more than 129,000 net new postpaid accounts in the quarter. However, the much lower-margin prepaid business in Mexico experienced yet another quarter of over half a million net additions, surpassing the 8 million active account mark for the first time ever.

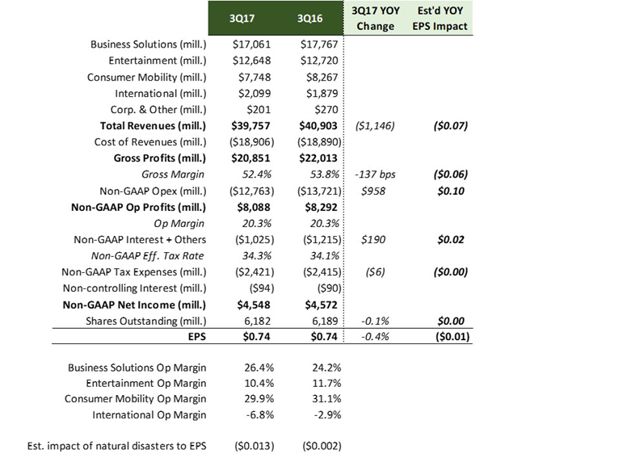

Further down the P&L, the YOY dip in gross margin that I had anticipated in my earnings preview materialized. The rate decreased by -137 bps to 52.4%, resulting in an estimated six-cent headwind to EPS on a YOY basis (see table below). As I had previously indicated, I expect gross margin to remain under pressure as the Big Four carriers in the U.S. continue to fight a fierce competitive war that, so far, has seen in the market’s underdog the only clear winner. On the entertainment side, a fast mix shift away from higher-priced legacy services (DirecTV and U-verse) will likely contribute further to the margin drag.

Not surprisingly, AT&T managed to keep opex under control, which helped to contribute ten cents to YOY EPS growth, per my estimates. Lower operating costs, in fact, fully countered gross margin deterioration, and non-GAAP op margin remained flat YOY. Further EPS upside showed up below the op profit line, which I believe is unlikely to excite analysts and investors or make them more confident about AT&T’s prospects.

On the AT&T stock

Given the results of the quarter (particularly the unexciting metrics and financial results on the mobility side), I think T will be subject to further short-term weakness in stock price. If I am correct, however, I believe depressed valuations could open up an opportunity for the long-term investor to accumulate shares at an incredible projected dividend yield of 5.8% (I am assuming the company declares a dividend increase of one penny in December 2017). With FCF improving YOY due to lower capex and tight working capital management, I continue to see the dividend payments well protected.

I have little confidence that T might see share price uplift in the near term. But despite the known challenges, I continue to find an investment in the stock a rare opportunity, particularly for investors with a long-term view and/or in search of rich, periodic cash payments.

Note from the author: If you have enjoyed this article and would like to receive real-time alerts on future ones, please follow D.M. Martins Research. To do so, scroll up to the top of this screen and click on the orange “Follow” button next to the header, making sure that the “Get email alerts” box remains checked. Thanks for reading.

Disclosure: I am/we are long T.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Tech